ISS Market Intelligence has released the latest edition in the Windows into Defined Contribution series. The Q4 2023 edition discusses full year 2022 defined contribution results, examining the declines in retirement plan assets alongside the moderation in plan outflows.

2022 proved to be a difficult year for stakeholders across the investment landscape. The Federal Reserve’s campaign to tamp down on historically high inflation led to substantial market declines across equity and bond markets, contributing to plunging account balances while interfering with investors’ ability to diversify via traditional strategies. This also prompted a historic surge in redemptions out of mutual funds and ETFs. Active funds in particular faced their worst year of net flows on an absolute and proportional basis. However, within the defined contribution market, outflows moderated substantially, interrupting a multi-year trend of worsening redemptions.

Retirement investors holding steady

The post-COVID period featured significant whipsaws in DC plan activity. The year 2020 saw assets soar thanks to rebounding markets, net flows move sharply negative, and the total number of active participants decline for the first time since 2008. Assets continued to recover strongly through 2021 as contribution rates rebounded and the market recorded a historic increase in rollovers.

Those trends reversed sharply over the course of 2022. Form 5500 data released by the U.S. Department of Labor and captured within the ISS MI BrightScope Defined Contribution Plan database saw assets take a substantial hit, falling by more than $1 trillion from $8.6 trillion at year-end 2021 to $7.2 trillion in 2022. Mutual funds and ETFs in the wider public investment market meanwhile witnessed saw assets shrink by $5 trillion over the same period, decreasing from $27.2 trillion in 2021 to $22.4 trillion.

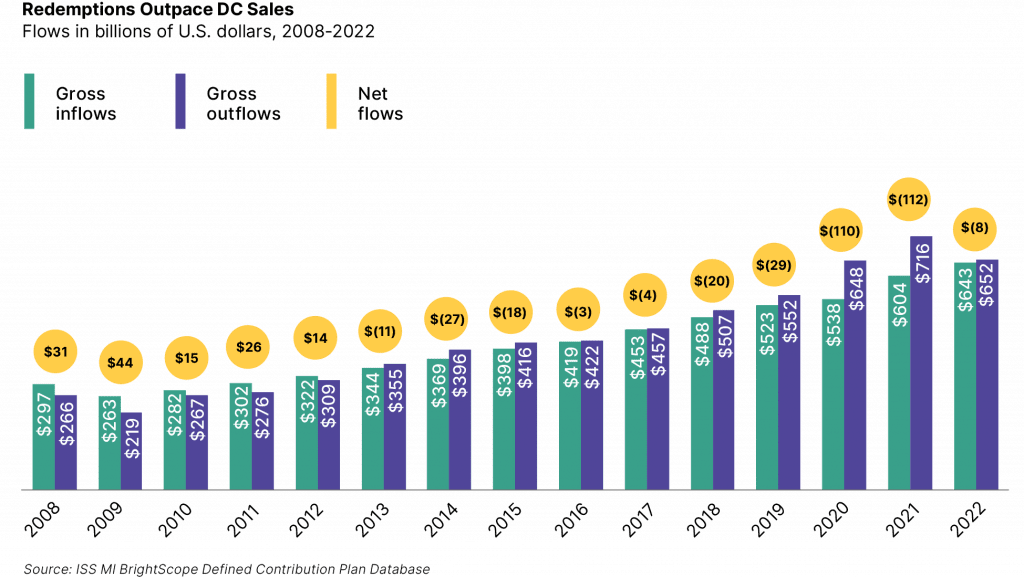

The asset declines across 2022 weighed on managers who suffered declining fee revenue and investors who faced diminished account balances. The large cohort of baby boomers in or nearing retirement rendered this an even more concerning issue. A substantial portion of investors appear to have responded to this market downturn by limiting their withdrawals. Net flows remained negative across 2022 to the tune of $8.2 billion, but on a relative scale, this served as a drastic improvement. Sales had been net negative for a full decade, with the space moving into the red starting in 2013, but the post-pandemic environment had recorded new depths in investor withdrawals. Net outflows across 2020 and 2021 surpassed $100 billion, when 2019 had witnessed outflows of just $28.5 billion. The table below displays annual gross inflows and gross outflows over the past 15 years, demonstrating how wide that gap had grown.

The moderation in net figures came more extensively from a pullback in redemptions than a boost in gross sales. Gross inflows have increased year-over-year even as net figures plunged, with gross contributions from both employers and participants recording steady growth. DC plans’ connection through the employer channel has provided a steady engine to bring in participants and keep them invested through multiple stages of a market cycle. Increasing redemptions happen to have counteracted those increases as more investors reach retirement age and withdraw the substantial balances they have built up over their careers.

Fortunately, this significant reduction in outflows is not simply the manifestation of DC plans being available to a smaller, more elite cohort. The number of plans and participants continued to increase at growth rates in line with previous years. Opportunities within the labor market have allowed investors on the margin of retiring to continue working and postpone their withdrawals.

The full report is available to Simfund Enterprise subscribers for access on the Simfund research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Jun Frank, Managing Director, Global Head of Compensation & Governance Advisory, ISS-Corporate