The ongoing transformation of the investment landscape across Canada is rapidly intensifying as ETFs continue to gain traction across distribution channels. Driven by the rise of fee-based advice and the growing popularity of model portfolios, ETFs are increasingly being favored for their low costs and transparency.

In line with global trends, mutual funds still dominate in Canada, holding 80% of assets (compared to 63% in the U.S.), according to ISS MI MarketPulse data. But financial wealth flows have increasingly shifted toward ETFs in recent years, signaling a broader evolution in investor preferences. Historically, mass and mid-market distribution networks had limited access to ETFs and exchanges. Today that’s changing. Access is steadily improving, opening new pathways for product growth and investor choice.

Access the full analysis in ISS MI’s latest Insight Investment Funds Report, available now to MarketSage subscribers.

As market access expands, we are seeing real-time effects on equity mandates, which are increasingly suited for index-based strategies. Since 2022, equity mutual funds have recorded outflows of $43 billion, while equity ETFs have attracted $132 billion in inflows. Notably, more than 61% of these ETF inflows have gone into index-tracking mandates.

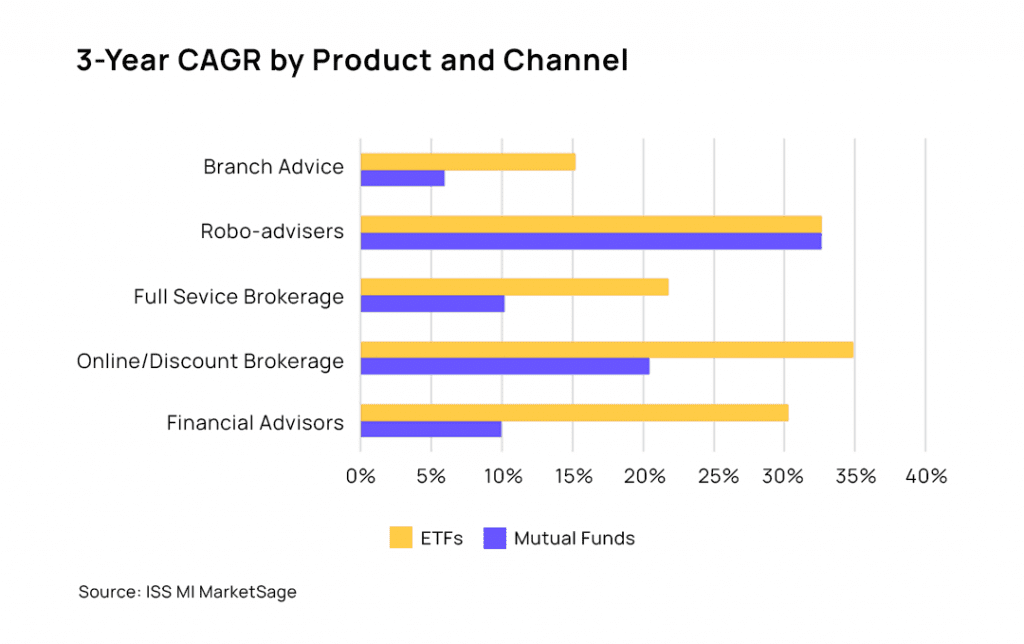

Brokerages lead in ETF usage

Full-service brokerages (FSBs) and online/discount brokerages (ODBs) have become key drivers of ETF adoption. These platforms, already familiar with trading exchange-listed securities, are well-positioned to meet the growing demand for ETFs.

Since June 2022, ODBs have led all distribution channels in ETF asset growth in Canada, posting an impressive compound annual growth rate of 35%. Their ability to attract new assets reflects a broader global shift toward fee-based models. In this environment, passive ETFs are a natural fit for these channels.

Meanwhile, other distribution networks are gradually integrating ETFs into their offerings. Branch advisors and independent financial advisors, who have traditionally been reliant on actively managed mutual funds, are beginning to incorporate ETFs into portfolio solutions. This shift is often facilitated through model portfolios, which bundle multiple investment products into a single, scalable solution.

Fee-based models support further adoption

The shift toward fee-based advice has altered advisor incentives, favoring low-fee products that deliver value. This evolution also supports the continued growth of ETFs and model portfolios, positioning them as central components of modern wealth management strategies.

Model portfolios are reshaping how advisors manage client assets, offering scalable solutions that streamline fund selection and asset allocation. These portfolios, often embedded within mutual fund wrappers or separately managed accounts, allow firms to maintain margin control while providing cost-effective investment options.

Index funds remain the primary winners for ETF

ETF assets at FSBs and ODBs remain heavily concentrated in index-tracking products. However, at the same time active ETF launches continue to outpace passive offerings in Canada. According to ISS MI’s February Insight report, which is available to MarketSage subscribers, more than 70% of ETF launches in 2024 were in active mandates. Still, passive investing remains the original use case for ETFs and continues to dominate flows—especially in self-directed accounts.

Across Canadian brokerages, when investors and advisors utilize U.S.-domiciled funds, over 90% of assets are allocated to passive products—significantly higher than the two-thirds share seen in Canadian-listed products. Funds with similar mandates and potential returns often carry lower fees in the U.S. due to scalability. However, currency risk and other factors still result in approximately three-quarters of passive investment being allocated to Canadian-listed funds.

As the industry continues to evolve, the implications for asset managers are profound. Success increasingly depends on staying closely aligned with shifting platform dynamics and investor expectations. To remain competitive in the next decade of Canadian wealth management, asset managers should focus on:

- Aligning with platform preferences

- Delivering cost-effective solutions

- Demonstrating clear value to advisors and investors

While mutual funds remain dominant in some channels, the momentum behind ETFs and model portfolios suggest a future where distribution is more centralized, transparent, and fee-conscious. Staying closely aligned with these evolving dynamics will be critical for asset managers aiming to thrive in the next decade of Canadian wealth management.

By Zachary Greifenberger, Associate, ISS Market Intelligence